The Smartest Addition to Your Team Doesn’t Need a Desk

Your next strategic hire won’t show up on payroll—Fractional BI delivers boardroom clarity, margin control, and a $13-to-$1 ROI without the overhead.

Let’s Be Honest—You’re Making Big Decisions with Partial Visibility

You’ve got revenue. You’ve got momentum. You’ve got a leadership team that’s sharp and hungry. But when it’s time to answer the hard questions—Where are we leaking margin? Which segments are quietly eroding profitability? What’s our real CAC-to-LTV by channel?—you stall.

Not because you’re indecisive.

Because your data isn’t built to answer those questions.

Your dashboards are decorative.

Your analysts are buried.

Your decisions are still driven by instinct, not insight.

This is the clarity gap. And it’s costing you—quietly, consistently, and more than you think.

The BI Spend Illusion

You’ve probably heard the rule: companies should invest 0.5% to 1.5% of annual revenue in business intelligence. For a $50M company, that’s $250K to $750K a year.

But here’s what actually happens:

You spend that much and still get dashboards that don’t drive decisions

You spend nothing and rely on spreadsheets and gut instinct

Or you spend somewhere in between and hope it’s “good enough”

The truth? Most BI spend is either bloated or brittle. And neither gives you the clarity you need.

Even among firms with strong BI infrastructure, only 33% report using data to drive proactive decisions. The rest? They’re stuck in reactive mode—reporting what happened, not guiding what’s next.

Fractional BI: Built for Leaders Who Want Clarity Without the Bloat

Fractional Business Intelligence flips the model. Instead of hiring a full-time team or outsourcing to a bloated consultancy, you bring in a senior BI strategist—fractionally. They build exactly what you need, when you need it, and nothing you don’t.

This isn’t about dashboards. It’s about leverage.

What you get:

Dashboards that speak the language of margin, growth, and risk

Strategic alignment across ops, finance, and sales

Rapid iteration—weeks, not quarters

Executive-grade insights that drive action

All for under 0.25% of annual revenue

It’s clarity-as-a-service. Built for velocity, precision, and boardroom confidence.

What This Looks Like in Practice

Let’s say you’re a $30M SaaS firm. You’re trying to reduce churn and justify GTM spend. With fractional BI, you get:

A dashboard that isolates churn by cohort, segment, and NPS

A clean CAC-to-LTV view by channel—not just blended averages

A spend map that shows where dollars are driving retention vs. noise

And you get it in weeks—not months. No hiring. No platform lock-in. Just clarity.

Or maybe you’re a nonprofit with $10M in annual donations. You want to show impact, optimize spend, and build trust with your board. Fractional BI gives you:

A dashboard that ties program spend to outcomes

A donor segmentation view that shows who’s giving, why, and when

A clean story that builds confidence with funders

Again—weeks, not months. And a fraction of the cost.

The Strategic ROI

Let’s talk numbers.

According to Nucleus Research, BI implementations yield an average $13 return for every $1 invested. That’s not a rounding error—it’s a strategic multiplier.

And from my experience architecting BI systems across SaaS, healthcare, finance, and nonprofit sectors, that return can be significantly higher when the solution is tailored to executive priorities and built for decision velocity.

Companies using BI make decisions 5x faster than those without it.

Visual data is processed 60,000x faster than text—making dashboards a critical executive tool.

But those stats only matter if your BI is built to answer the right questions:

Where are we leaking margin?

Which segments are quietly eroding profitability?

What’s our true CAC-to-LTV by channel?

Where can we reallocate spend for maximum impact?

Fractional BI is built to answer those questions. Directly. Strategically. Fast.

Why It Works

Because fractional BI isn’t about tools. It’s about decision infrastructure.

You’re not buying dashboards. You’re buying confidence.

You’re not investing in data. You’re investing in leverage.

You’re not hiring analysts. You’re enabling decisive leadership.

It’s the difference between “we think” and “we know.”

Between “we hope” and “we’re ready.”

And in today’s market, readiness is everything.

The Implementation Roadmap

A successful fractional BI engagement follows a structured, outcome-driven approach:

Executive Alignment

Define strategic priorities (e.g., margin optimization, churn reduction, spend reallocation)Diagnostic Assessment

Audit existing data assets, reporting tools, and decision workflowsArchitecture Design

Build lean, scalable dashboards tailored to executive use casesRapid Deployment

Launch MVP dashboards within 30–45 days, with weekly iteration cyclesOngoing Optimization

Refine metrics, expand use cases, and embed BI into leadership cadence

This isn’t a tech project. It’s a strategic enablement layer.

Bottom Line

If you’re spending six figures on BI and still flying blind—or spending nothing and hoping for the best—it’s time to rethink the model.

Fractional BI gives you:

Strategic clarity

Operational control

Boardroom confidence

At a fraction of the cost.

Let’s architect a fractional BI model tailored to your revenue tier, leadership cadence, and strategic priorities. Because in today’s market, the companies that win aren’t the ones with the most data. They’re the ones who know what to do with it.

And they don’t wait for clarity. They build it.

Compensation Benchmarking: A Strategic Guide for HR Executives

Building Competitive, Equitable, and Retentive Pay Structures

As an HR executive, you know that compensation isn’t just about numbers—it’s a critical component of your organization’s talent strategy. Whether you’re addressing employee concerns about pay or losing top talent to competitors, a well-executed compensation benchmarking project can transform how your organization attracts and retains employees.

Here’s what you need to know to approach compensation benchmarking effectively and ensure it supports your business goals.

What is Compensation Benchmarking?

Compensation benchmarking involves comparing your organization’s roles with external market data to determine their market value. By analyzing salary data from multiple reliable sources, you can ensure that your pay structures are competitive and aligned with market trends.

But it’s not just about matching numbers. Effective benchmarking also considers your organization’s compensation philosophy and internal equity, making it as much an art as a science.

Two Approaches: Internal vs. External Benchmarking

The question for many HR leaders is whether to manage the process in-house or bring in a compensation consultant. Let’s break down the considerations for each approach.

Conducting Benchmarking In-House

For organizations with a well-resourced HR team, managing benchmarking internally can be a cost-effective solution. To succeed, you’ll need the following:

1. Reliable Salary Surveys

Investing in at least three credible salary surveys is essential for accurate benchmarking. These can cost anywhere from a few hundred to tens of thousands of dollars, depending on your industry and location. Free online salary data often lacks the precision and credibility required for effective benchmarking.

2. Expertise and Time

Benchmarking is detail-oriented and time-consuming. Experienced compensation professionals spend 15–30 minutes per role, while less experienced individuals face a steep learning curve. Mistakes—like misinterpreting data or selecting incorrect benchmarks—can lead to costly errors in your pay structure.

Key Challenges

• Ensuring your job descriptions are accurate and up-to-date.

• Balancing the time commitment with other HR priorities.

• Interpreting data correctly to avoid overpaying or underpaying employees.

If your team has the tools and expertise, in-house benchmarking may work. Otherwise, outsourcing can provide valuable insights and efficiencies.

The Case for Hiring a Compensation Consultant

When resources are stretched or expertise is limited, working with a compensation consultant offers several advantages:

1. Comprehensive Survey Data and Tools

Consultants have access to extensive, reliable salary surveys across industries, regions, and job levels. They use sophisticated tools to aggregate and analyze data, ensuring accuracy and consistency.

2. Compensation Expertise

Many HR teams lack specialists in compensation. Consultants bring deep expertise, industry knowledge, and a focus on pay strategy. They can identify salary gaps, calculate the cost of adjustments, and provide recommendations for aligning pay with your organizational goals.

3. Actionable Insights

Beyond benchmarking, consultants guide you on implementing changes. For example, they can analyze pay gaps, assess competitiveness, and help communicate adjustments to employees—all while keeping the process aligned with your compensation philosophy.

Potential Challenges

The primary downside to hiring a consultant is that they don’t have institutional knowledge of your workforce. Accurate job descriptions and collaborative input are critical to ensuring a successful project.

Why Benchmarking Matters to HR Leaders

Done well, compensation benchmarking provides significant benefits to HR leaders:

• Enhances Retention: Competitive pay structures help retain top performers.

• Improves Recruitment: Market-aligned salaries attract high-quality talent.

• Controls Costs: Data-driven decisions minimize unnecessary payroll expenses.

• Supports Equity: Transparent structures ensure fairness and legal compliance.

By aligning your pay practices with market trends and organizational goals, you’re investing in a compensation strategy that supports both your workforce and your business outcomes.

Proklamate: Your Partner in Compensation Benchmarking

At Proklamate, we specialize in tailored compensation benchmarking solutions designed to empower HR leaders like you. Our approach goes beyond generic salary reports to deliver actionable insights:

• Geographic-Specific Analysis: Understand pay trends in your local market.

• Job Tenure Analytics: Evaluate pay based on experience and career progression.

• Top Matches for Your Roles: We provide detailed comparisons for the three best-matched positions to ensure accuracy.

Best of all, there are no subscriptions or strings attached—just project-based support when you need it.

We also collaborate with America’s premier HR consulting firms, connecting cutting-edge data with professionals who understand the human side of compensation.

Start the new year with a strategic pay structure that positions your organization for success. Contact Proklamate to learn how we can help you build a competitive and equitable compensation strategy that delivers real results.

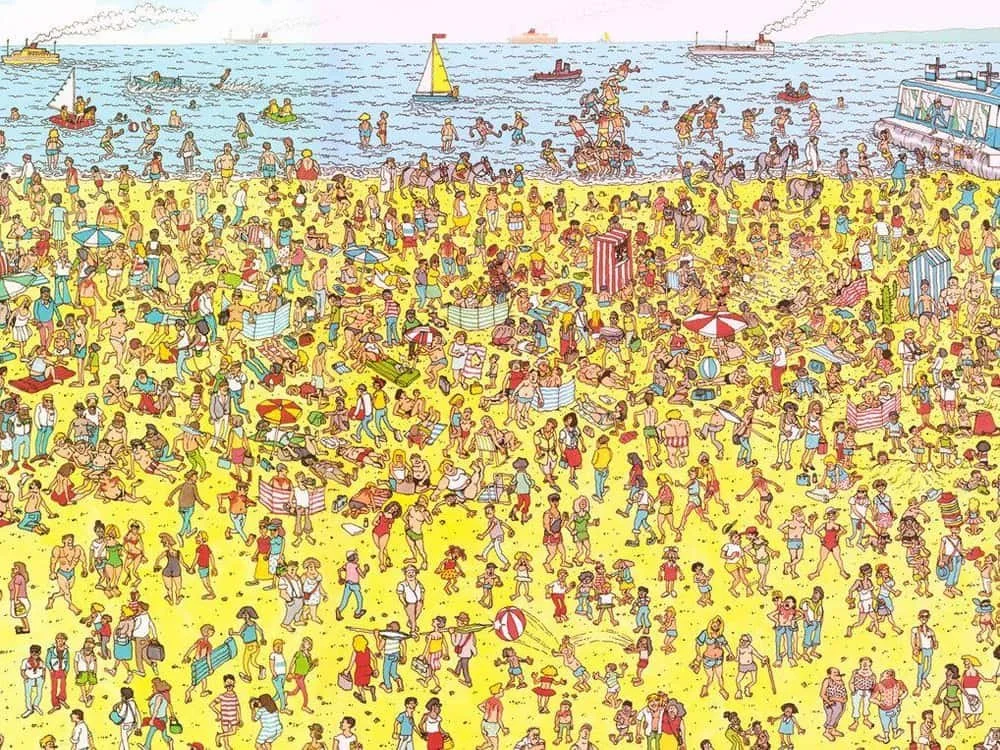

The Waldo Effect: Why We Miss Key Insights by Looking Too Hard for the Obvious

The Waldo Effect: Why You Miss Key Insights by Looking Too Hard for the Obvious

Imagine flipping open a “Where’s Waldo?” book. At first glance, the page is a chaotic sea of brightly colored distractions—balloons, beach balls, marching bands, and carnival rides. Amid the visual noise, you’re tasked with finding Waldo, the bespectacled, stripe-clad traveler. It’s tricky, but here’s the catch: once you know what to look for, you’re laser-focused. Everything else fades into the background. This is exactly how many of us approach data. We search for Waldo—our preconceived conclusion—often missing the critical insights that lie just outside of our narrow focus.

In the realm of data analytics, confirmation bias operates much like a Waldo hunt. We enter the fray with a hypothesis or a desired result, and we search for the data points that validate it. We may convince ourselves we’re making data-driven decisions, but in reality, we’re cherry-picking the figures that support what we wanted to find all along. The problem? The truth, like Waldo, is often hiding in plain sight, just beyond the borders of our assumptions.

The Science of “Only Seeing Waldo”

This phenomenon is not just a fun analogy—it’s deeply rooted in how our brains work. In psychology, this is referred to as inattentional blindness, a cognitive bias where we fail to perceive things that aren’t directly within our focus. The classic example is Simons and Chabris’ “Invisible Gorilla” experiment: participants watching a video of people passing a basketball are so focused on counting the passes that they miss a person in a gorilla suit walking through the scene. In data analysis, this “invisible gorilla” might be a hidden trend or outlier that goes unnoticed simply because we weren’t looking for it.

As Nobel laureate Daniel Kahneman explains in Thinking, Fast and Slow, our brains are wired to operate in two systems: fast (intuitive) and slow (analytical). When we scan a dataset, we tend to engage our fast, intuitive system—spotting patterns that align with what we expect to find. This cognitive shortcut is efficient, but it’s also where the danger lies. Kahneman notes, “We can be blind to the obvious, and we are also blind to our blindness.”

Real-World Data Blindness: Case Studies

One notorious example of this selective perception comes from the 2008 financial crisis. In the lead-up to the collapse, financial institutions and rating agencies were so focused on the booming housing market that they overlooked clear warning signs of an impending subprime mortgage meltdown. In hindsight, the data pointed to over-leveraged consumers, risky loans, and an inflated housing bubble. But because key players were focused on validating their bullish view of the market, they missed the data points that contradicted their optimism. As financial analyst Michael Burry, one of the few who saw the crash coming, put it: “It is ludicrous to believe that asset bubbles can only be recognized in hindsight.”

In the corporate world, Blockbuster serves as another example of data blindness. As Netflix and digital streaming grew, Blockbuster remained hyper-focused on brick-and-mortar store revenue metrics. Had they expanded their data focus to include emerging trends in digital media consumption, they might have seen the “gorilla” walking through their profits and made strategic pivots in time.

Why We Miss the “Waldo” in Our Data

At the heart of this issue is the way we frame our analysis. If we go into an analysis looking to prove a hypothesis, we’re essentially setting ourselves up to find Waldo—no matter how hidden or irrelevant he might be. A study published in The American Statistician highlighted how p-hacking—the practice of running numerous statistical tests until a significant result is found—can lead to misleading conclusions. Essentially, we’re crafting the narrative we want to see, rather than allowing the data to speak for itself.

This bias becomes even more dangerous in the context of big data, where the sheer volume of information makes it easier to cherry-pick data points that fit a narrative. It’s the digital equivalent of turning page after page in a Waldo book, ignoring entire scenes because we’ve already convinced ourselves that Waldo must be at the beach, not the carnival.

How to Broaden Your Data Search (And Avoid Tunnel Vision)

So how do we break free from the trap of only seeing what we’re looking for? Here are a few strategies:

Expand the Frame of Reference: Instead of starting with a specific hypothesis, approach the data with curiosity. Look for trends, outliers, and anomalies that don’t immediately fit your expectations. As Nate Silver, founder of FiveThirtyEight, wisely said, “Data doesn’t create meaning. People do.”

Use Data to Disprove, Not Just Prove: As counterintuitive as it sounds, try to use your data to disprove your initial hypothesis. This forces you to actively search for information that challenges your assumptions. By doing this, you’re less likely to fall prey to confirmation bias.

Ask for a Fresh Pair of Eyes: When we’re deep in the data trenches, it’s easy to miss key insights. Having someone else—preferably with a different perspective—review your analysis can reveal overlooked patterns. Remember, another person might be searching for an entirely different Waldo.

Leverage Predictive Analytics: Sometimes, the “Waldo” you’re not seeing is hidden in future trends. Predictive analytics uses historical data to forecast future outcomes, helping you catch emerging patterns that aren’t immediately obvious in a backward-looking analysis. But keep in mind, predictive models are only as good as the diversity and quality of the data that goes into them.

Conclusion: Searching for More Than Waldo

In a world overflowing with data, it’s easy to fall into the trap of only seeing what we’re looking for. But by expanding our focus beyond the metaphorical Waldo—whether it’s a preconceived conclusion, a favorable metric, or a convenient trend—we open ourselves up to the full breadth of insights that data can provide.

As Albert Einstein famously said, “Not everything that can be counted counts, and not everything that counts can be counted.” So, the next time you dive into a dataset, ask yourself: Am I finding Waldo, or am I seeing the bigger picture?

References:

Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2011.

Silver, Nate. The Signal and the Noise: Why So Many Predictions Fail - But Some Don’t. Penguin Books, 2015.

Simons, Daniel J., and Christopher Chabris. “Gorillas in our midst: Sustained inattentional blindness for dynamic events.” Perception, 1999.