A Deep Dive into the Gartner Magic Quadrant: Its Influence, Its Limitations, and How I Leverage It

A Deep Dive into the Gartner Magic Quadrant: Its Influence, Its Limitations, and How I Leverage It

As a business leader, you’re constantly navigating a landscape where new technology solutions and service providers are being introduced at a rapid pace. How do you decide which vendor is right for you? The Gartner Magic Quadrant (MQ) has become a popular tool for decision-makers seeking clarity in the sea of options. At first glance, it offers a powerful snapshot—simplifying complex markets into four neat quadrants, each reflecting a vendor’s ability to execute and the completeness of their vision. But, in practice, I’ve learned that the value of the Magic Quadrant isn’t always as straightforward as it appears.

What Is the Gartner Magic Quadrant?

The Gartner Magic Quadrant is a research methodology and visualization tool that evaluates vendors within specific markets, ranking them based on two dimensions: ability to execute and completeness of vision. Vendors are placed into one of four categories:

Leaders: Companies that excel both in execution and vision. They typically have a strong market presence, proven technology, and a solid roadmap for future innovation.

Challengers: Strong on execution but may lack a forward-thinking vision or innovation strategy. They’re reliable but not necessarily groundbreaking.

Visionaries: Companies that have bold, innovative ideas but may not yet have the operational maturity or market share to fully execute them.

Niche Players: These are often smaller vendors with specialized solutions. They may not have the broad market appeal of Leaders but can offer targeted, high-quality solutions in specific domains.

The quadrant itself offers a clear, visually compelling representation of market players. It’s especially attractive to executives who need to make decisions quickly and want to rely on an objective third-party assessment. However, as I’ve worked with businesses to make strategic technology decisions, I’ve come to realize that the simplicity of the MQ is both its greatest strength and its most significant limitation.

Does It Work? The Magic Quadrant in Practice

In theory, the Magic Quadrant is a fantastic tool for those seeking a high-level view of a particular market. It cuts through the noise, providing a quick summary of who the major players are and what their relative strengths and weaknesses might be. But when we dig deeper, there are some complexities and limitations that are worth considering.

First, the MQ is based on criteria that might not align with the unique needs of your business. Gartner evaluates vendors on a set of standardized factors, but what happens when your business priorities don’t match those criteria? For example, Gartner may value scalability and market presence heavily, but your business might prioritize niche functionality, support services, or integration capabilities that aren’t heavily weighted in the MQ. While it can be a useful starting point, relying solely on it risks overlooking these crucial nuances.

Moreover, Gartner’s analysis is retrospective. The data used to create the Magic Quadrant comes from past performance and current market positioning. It doesn’t always reflect the rapid pace of innovation or the changing needs of businesses in real time. I’ve seen companies labeled as “Visionaries” because they were pushing the envelope in terms of innovation, even though they lacked a robust market presence. In some cases, those Visionaries ended up being the perfect fit for my clients because their offerings were better aligned with specific growth goals. Meanwhile, the Leaders—companies with strong market execution but a more conservative roadmap—didn’t offer the flexibility my clients needed to innovate and stay competitive.

The Science Behind the Magic Quadrant

The methodology that underpins the Magic Quadrant is rigorous, but it’s not immune to biases and limitations. Gartner analysts rely on both qualitative and quantitative data to rank vendors. They consider vendor briefings, customer feedback, and independent research. However, there are a few key things to keep in mind:

1. Data Collection and Selection Bias: The vendors featured in the MQ often choose to participate in the process, and they can influence the data Gartner receives by selectively sharing customer success stories or innovation roadmaps. This introduces the potential for selection bias, where vendors only showcase their best work.

2. Market Focus: Gartner tends to emphasize vendors that appeal to the broadest swath of the market. Niche players or smaller companies that focus on specialized sectors might not rank as highly, even if they deliver best-in-class solutions for their specific domains.

3. Time Lag: As mentioned earlier, the Magic Quadrant is based on data collected from past performance. This means that if a company has recently introduced a disruptive new product or service, it may not be fully reflected in the current quadrant.

4. Scalability vs. Specificity: Gartner tends to reward scalability and market dominance. But as I’ve seen, some businesses don’t necessarily need the biggest player—they need the right player, the one that understands their specific needs. In these cases, a “Niche Player” might actually deliver better results.

How It Influences Business Strategy

So how does this all affect how I lean into business? In my experience, the Gartner Magic Quadrant can be both a useful tool and a potential blind spot. It provides a solid starting point for vendor evaluation but should never replace a thorough, personalized vetting process. When I work with clients, I use the MQ as one data point among many. It can give us an idea of market trends and vendor positioning, but it’s not the final word on which vendor is the right fit.

In practice, I’ve found that businesses thrive when they combine insights from the MQ with their own detailed assessments. This involves looking beyond where a vendor sits on the chart and diving into real-world performance—examining customer reviews, hands-on trials, and how well a vendor aligns with your strategic goals. Just because a vendor is in the “Leaders” quadrant doesn’t mean they’re automatically the right fit for every situation. Sometimes the most innovative solutions come from “Visionaries” who have a deep understanding of where the market is heading, or from “Niche Players” who specialize in solving the exact problems your business faces.

In this way, the Magic Quadrant helps me shape the conversation but doesn’t dictate the outcome. It’s a tool, not a solution. And in a world where businesses must stay agile, lean, and customer-centric, making decisions based solely on a vendor’s quadrant placement can leave you blind to better, more tailored opportunities.

A Balanced Approach

The Gartner Magic Quadrant is undeniably valuable. It’s backed by research, data, and expertise that can help narrow down vendor options and provide a high-level understanding of the market. But it has limitations. Its one-size-fits-all approach might not always align with the specific needs of your business, and it can overlook the nuances that come with selecting the right vendor for your long-term strategy.

Ultimately, what I’ve learned is that while the Magic Quadrant can influence decisions, it works best as part of a broader, more detailed evaluation process. I lean into business by using the MQ as a reference, but I always prioritize real-world fit, flexibility, and long-term value over a vendor’s position on the grid. And when it comes to driving business growth, I believe in finding the right solution—not just the most popular one.

Pumpkin Spiced Profits: The Science and Economics of Autumn’s Favorite Cup of Joe

Pumpkin Spiced Profits: The Science and Economics of Autumn’s Favorite Cup of Joe

As the Boise leaves begin to turn and the air takes on that crisp edge, one thing is certain: fall coffee season is upon us. The arrival of the Pumpkin Spice Latte (PSL), now a cultural phenomenon, signals the start of a highly profitable season for coffee shops and retailers alike. But have you ever stopped to wonder just how much data, research, and economic forecasting goes into crafting the perfect fall coffee blend? Let’s take a sip of the science, business, and consumer insights that fuel the autumn beverage frenzy.

The Pumpkin Spice Empire

While it may feel like pumpkin spice has been around forever, it was Starbucks that first introduced the world to the PSL in 2003. Since then, the drink has become an annual sensation, driving significant sales. In fact, Starbucks has sold more than 600 million Pumpkin Spice Lattes since its inception, generating over $1.4 billion in revenue from the drink alone . In 2022, 41% of coffee drinkers indicated that they would be more likely to visit a café if it offered seasonal drinks, with pumpkin spice being the top favorite.

Why the pumpkin craze? A 2021 Nielsen report showed that U.S. pumpkin-flavored products alone generated over $511 million in sales. That’s up 10% from the previous year, showing that despite being a limited-time offer, the demand for seasonal flavors continues to climb.

The Science of Fall Flavors

What makes a PSL so irresistibly “fall” flavored? The answer lies in the blend of spices used in the syrup, which typically includes cinnamon, nutmeg, ginger, and cloves. These spices trigger a sensory response tied to nostalgia and warmth, according to Dr. Charles Spence, a professor of experimental psychology at the University of Oxford. He explains that these spices tap into our olfactory memory, reminding us of cozy autumnal experiences like baking or sitting by the fire .

Furthermore, there’s psychological priming at play. Consumers associate the color orange (i.e., pumpkins) and the smell of spice with cooler weather and fall activities. According to a study in the journal Food Quality and Preference, these flavors are seen as more desirable during autumn months because they tap into our seasonal expectations .

The Economics of Fall Coffee

From an economic perspective, the data shows just how crucial seasonal drinks like the PSL are to driving business during the colder months. Research from the National Coffee Association shows that 66% of Americans drink coffee every day, and seasonal drinks can cause a 15-20% boost in sales during peak fall months. This surge happens when typical coffee drinkers add a fall flavor to their routine, or when rare coffee buyers are drawn in by the seasonality of pumpkin spice or caramel apple concoctions .

For brands, the margin on these specialty drinks is high. A standard cup of brewed coffee costs a café roughly $0.15 to make, while a PSL, despite being more expensive to prepare due to the syrups and milk, has a profit margin of about 80% . This profitability is what drives coffee shops to roll out extensive fall menus, filled with not just PSLs, but everything from spiced chai lattes to maple-flavored cold brews.

Pumpkin By the Numbers

What about the pumpkin itself? The U.S. is the largest producer of pumpkins in the world, with more than 1.5 billion pounds harvested annually, primarily from Illinois, which accounts for 80% of the nation’s pumpkin crop . However, most of the pumpkin used in our lattes doesn’t come from actual pumpkin purée—rather, it’s a combination of artificial flavorings and spices designed to replicate that pumpkin-y goodness.

Though Starbucks made a significant move in 2015 by adding real pumpkin to its PSL recipe, the amount is still relatively minimal compared to the impact of the spices, which do the heavy lifting in creating the autumnal flavor profile .

Why We Keep Coming Back

While data and economics help explain why coffee shops love fall drinks, consumer psychology explains why we, as customers, can’t resist them. Seasonal drinks create a sense of exclusivity and urgency. According to Dr. Kelly Goldsmith, a professor of marketing at Vanderbilt University, “When something is available for a limited time, people are more likely to view it as a scarce resource, which drives up demand.”

This principle of scarcity leads to what retailers call “fear of missing out” (FOMO), encouraging customers to get their PSL fix before it’s too late. As a result, seasonal drinks are marketed as must-have experiences, not just beverages.

Final Thoughts

The autumn coffee season, led by the ever-popular Pumpkin Spice Latte, is a perfect example of how data, consumer behavior, and clever marketing converge to create a massively profitable trend. From the psychology of flavor to the economics of scarcity, the science of fall coffee is more complex—and more lucrative—than you might think.

So, next time you cozy up with your pumpkin-spiced drink, remember: you’re not just sipping coffee; you’re sipping on a carefully crafted, data-driven success story.

Sources:

• Starbucks data, revenue stats

• Nielsen report on pumpkin-flavored product sales

• Dr. Charles Spence on sensory nostalgia

• National Coffee Association on coffee drinking habits

• U.S. pumpkin production data from USDA

The Waldo Effect: Why We Miss Key Insights by Looking Too Hard for the Obvious

The Waldo Effect: Why You Miss Key Insights by Looking Too Hard for the Obvious

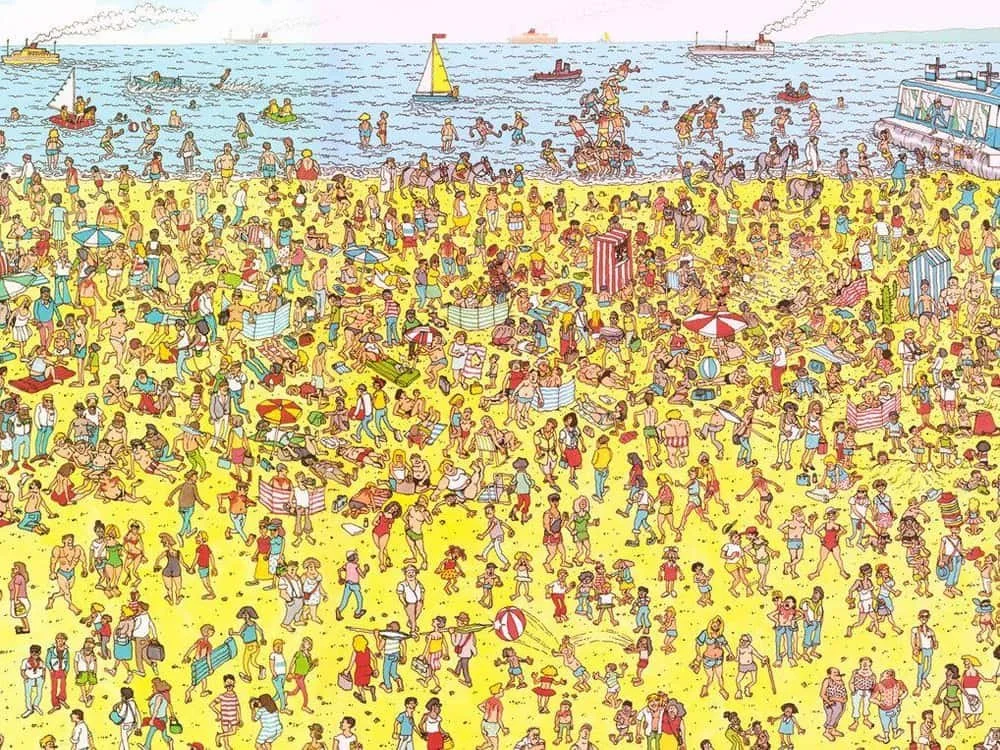

Imagine flipping open a “Where’s Waldo?” book. At first glance, the page is a chaotic sea of brightly colored distractions—balloons, beach balls, marching bands, and carnival rides. Amid the visual noise, you’re tasked with finding Waldo, the bespectacled, stripe-clad traveler. It’s tricky, but here’s the catch: once you know what to look for, you’re laser-focused. Everything else fades into the background. This is exactly how many of us approach data. We search for Waldo—our preconceived conclusion—often missing the critical insights that lie just outside of our narrow focus.

In the realm of data analytics, confirmation bias operates much like a Waldo hunt. We enter the fray with a hypothesis or a desired result, and we search for the data points that validate it. We may convince ourselves we’re making data-driven decisions, but in reality, we’re cherry-picking the figures that support what we wanted to find all along. The problem? The truth, like Waldo, is often hiding in plain sight, just beyond the borders of our assumptions.

The Science of “Only Seeing Waldo”

This phenomenon is not just a fun analogy—it’s deeply rooted in how our brains work. In psychology, this is referred to as inattentional blindness, a cognitive bias where we fail to perceive things that aren’t directly within our focus. The classic example is Simons and Chabris’ “Invisible Gorilla” experiment: participants watching a video of people passing a basketball are so focused on counting the passes that they miss a person in a gorilla suit walking through the scene. In data analysis, this “invisible gorilla” might be a hidden trend or outlier that goes unnoticed simply because we weren’t looking for it.

As Nobel laureate Daniel Kahneman explains in Thinking, Fast and Slow, our brains are wired to operate in two systems: fast (intuitive) and slow (analytical). When we scan a dataset, we tend to engage our fast, intuitive system—spotting patterns that align with what we expect to find. This cognitive shortcut is efficient, but it’s also where the danger lies. Kahneman notes, “We can be blind to the obvious, and we are also blind to our blindness.”

Real-World Data Blindness: Case Studies

One notorious example of this selective perception comes from the 2008 financial crisis. In the lead-up to the collapse, financial institutions and rating agencies were so focused on the booming housing market that they overlooked clear warning signs of an impending subprime mortgage meltdown. In hindsight, the data pointed to over-leveraged consumers, risky loans, and an inflated housing bubble. But because key players were focused on validating their bullish view of the market, they missed the data points that contradicted their optimism. As financial analyst Michael Burry, one of the few who saw the crash coming, put it: “It is ludicrous to believe that asset bubbles can only be recognized in hindsight.”

In the corporate world, Blockbuster serves as another example of data blindness. As Netflix and digital streaming grew, Blockbuster remained hyper-focused on brick-and-mortar store revenue metrics. Had they expanded their data focus to include emerging trends in digital media consumption, they might have seen the “gorilla” walking through their profits and made strategic pivots in time.

Why We Miss the “Waldo” in Our Data

At the heart of this issue is the way we frame our analysis. If we go into an analysis looking to prove a hypothesis, we’re essentially setting ourselves up to find Waldo—no matter how hidden or irrelevant he might be. A study published in The American Statistician highlighted how p-hacking—the practice of running numerous statistical tests until a significant result is found—can lead to misleading conclusions. Essentially, we’re crafting the narrative we want to see, rather than allowing the data to speak for itself.

This bias becomes even more dangerous in the context of big data, where the sheer volume of information makes it easier to cherry-pick data points that fit a narrative. It’s the digital equivalent of turning page after page in a Waldo book, ignoring entire scenes because we’ve already convinced ourselves that Waldo must be at the beach, not the carnival.

How to Broaden Your Data Search (And Avoid Tunnel Vision)

So how do we break free from the trap of only seeing what we’re looking for? Here are a few strategies:

Expand the Frame of Reference: Instead of starting with a specific hypothesis, approach the data with curiosity. Look for trends, outliers, and anomalies that don’t immediately fit your expectations. As Nate Silver, founder of FiveThirtyEight, wisely said, “Data doesn’t create meaning. People do.”

Use Data to Disprove, Not Just Prove: As counterintuitive as it sounds, try to use your data to disprove your initial hypothesis. This forces you to actively search for information that challenges your assumptions. By doing this, you’re less likely to fall prey to confirmation bias.

Ask for a Fresh Pair of Eyes: When we’re deep in the data trenches, it’s easy to miss key insights. Having someone else—preferably with a different perspective—review your analysis can reveal overlooked patterns. Remember, another person might be searching for an entirely different Waldo.

Leverage Predictive Analytics: Sometimes, the “Waldo” you’re not seeing is hidden in future trends. Predictive analytics uses historical data to forecast future outcomes, helping you catch emerging patterns that aren’t immediately obvious in a backward-looking analysis. But keep in mind, predictive models are only as good as the diversity and quality of the data that goes into them.

Conclusion: Searching for More Than Waldo

In a world overflowing with data, it’s easy to fall into the trap of only seeing what we’re looking for. But by expanding our focus beyond the metaphorical Waldo—whether it’s a preconceived conclusion, a favorable metric, or a convenient trend—we open ourselves up to the full breadth of insights that data can provide.

As Albert Einstein famously said, “Not everything that can be counted counts, and not everything that counts can be counted.” So, the next time you dive into a dataset, ask yourself: Am I finding Waldo, or am I seeing the bigger picture?

References:

Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2011.

Silver, Nate. The Signal and the Noise: Why So Many Predictions Fail - But Some Don’t. Penguin Books, 2015.

Simons, Daniel J., and Christopher Chabris. “Gorillas in our midst: Sustained inattentional blindness for dynamic events.” Perception, 1999.